WHAT IS A 51% ATTACK?

Introduction

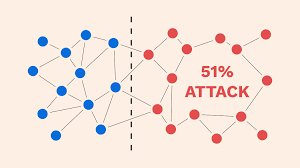

Blockchain technology, the backbone of cryptocurrencies, is celebrated for its security and decentralization. However, it is not immune to threats. One of the most significant threats is the 51% attack, where a single entity or group gains control over more than half of a blockchain’s hash rate or computing power. This article delves into the mechanics of a 51% attack, its implications, historical instances, and measures to prevent such attacks.

Understanding the 51% Attack

- Definition and Basics

- Definition: A 51% attack occurs when an individual or group controls more than 50% of the network’s mining hash rate or computational power. This allows them to disrupt the network’s operations.

- Basics: In a decentralized blockchain network, transactions are verified and added to the blockchain by miners. Consensus mechanisms like Proof-of-Work (PoW) rely on the distribution of computational power among numerous miners to maintain security and integrity.

- Mechanics of a 51% Attack

- Control of Hash Rate: The attacker gains more than 50% of the network’s total hash rate.

- Double Spending: With this control, the attacker can reverse transactions they made while also spending the same cryptocurrencies again, leading to double spending.

- Transaction Reversal: The attacker can prevent new transactions from gaining confirmations, halting payments between users.

- Block Exclusion: They can exclude or modify the ordering of transactions, effectively censoring specific transactions or users.

Implications of a 51% Attack

- Financial Losses

- Double Spending: Victims of double spending attacks can suffer significant financial losses, especially merchants and exchanges.

- Market Confidence: Such attacks can erode trust in the cryptocurrency, leading to a decline in its value and market confidence.

- Network Disruption

- Transaction Censorship: The attacker can censor transactions, preventing them from being confirmed.

- Blockchain Forks: Repeated 51% attacks can cause the blockchain to fork, leading to network instability.

- Damage to Reputation

- Loss of Trust: A successful 51% attack damages the reputation of the cryptocurrency, leading to a loss of user and investor trust.

- Market Impact: The broader cryptocurrency market can be affected as confidence in blockchain technology is shaken.

Historical Instances of 51% Attacks

- Bitcoin Gold

- Date: May 2018

- Details: Attackers gained control of the network and conducted double-spending attacks, leading to losses exceeding $18 million.

- Ethereum Classic

- Date: January 2019 and August 2020

- Details: The network experienced multiple 51% attacks, resulting in significant double-spending and network reorganization.

- Vertcoin

- Date: December 2018

- Details: Suffered from multiple 51% attacks, with the attackers executing double-spending transactions worth thousands of dollars.

Prevention and Mitigation Strategies

- Increased Network Hash Rate

- Explanation: A higher total network hash rate makes it more difficult and costly for an attacker to gain the necessary majority control.

- Implementation: Encouraging more miners to join the network and using more efficient mining hardware.

- Algorithm Adjustments

- Explanation: Regularly changing or improving the mining algorithm can thwart potential attackers.

- Examples: Implementing hybrid consensus mechanisms like PoW/PoS (Proof of Stake) to distribute control.

- Chain Reorganizations Limits

- Explanation: Limiting the ability to reorganize the blockchain (i.e., revert blocks) can reduce the impact of a 51% attack.

- Implementation: Setting stricter rules for chain reorganizations and deep reorganizations.

- Enhanced Detection and Response

- Explanation: Implementing systems to detect abnormal hash rate concentration and responding promptly.

- Implementation: Monitoring networks for unusual mining activity and coordinating a community response to threats.

- Community and Developer Vigilance

- Explanation: A vigilant and responsive community can help identify and mitigate the impacts of a 51% attack.

- Implementation: Keeping the community informed about potential threats and having a rapid response plan.

Conclusion

A 51% attack poses a significant threat to the integrity and security of blockchain networks. While Bitcoin, with its vast and decentralized hash rate, is less susceptible, smaller and less distributed cryptocurrencies remain vulnerable. Understanding the mechanics and implications of a 51% attack is crucial for users, developers, and investors in the cryptocurrency space. By implementing robust security measures and maintaining vigilant communities, the risk of such attacks can be mitigated, ensuring the continued trust and reliability of blockchain technology.